Your gift to the Santa Monica College Foundation backs SMC student success overall, giving the SMC Foundation the flexibility to target your investment where it is needed most in these changing and challenging times.

Please make checks payable to "SMC Foundation," write "Greatest Need" in the memo line or designate your gift as you prefer, and mail to:

SMC Foundation

1900 Pico Blvd.

Santa Monica, CA 90405

OPTION 1:

Send funds directly to SMCF with following information:

Bank Name: JPMorgan Chase Bank N.A.

Account Number: 583971588

Bank ABA Routing Number: 32271627

Bank Wire Routing Number: 021000021

View Chase ACH Instructions Letter

OPTION 2:

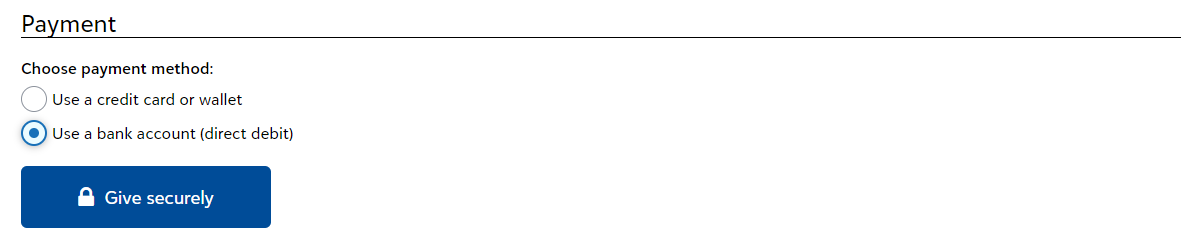

Every SMC Foundation donation form has the option to give by direct debit (instead

of CC) at the bottom of the form.

Donate your car, truck, motorcycle, RV, or boat to SMC by simply clicking the image

below and filling out the donation form. We'll reach out to you to arrange the pick-up

of your vehicle donation, at no cost to you. You may qualify for a tax deduction while

supporting a cause that is near and dear to your heart!

Vehicle donation pick-up is always free to you and most vehicles can be picked up

within 24-72 hours. You'll receive an initial car donation receipt upon pick-up and

then the Careasy team will work to turn your car into cash to support Santa Monica

College. Once your vehicle is sold, Careasy will provide you proper tax forms in time

to file. Careasy's friendly Customer Service Representatives are here 7 days a week

to assist throughout the process.

Support students, programs, and the greatest needs of Santa Monica College by making a gift of stock, mutual funds, or securities, or a gift via wire transfer or electronic funds (ACH transfer).

You can create a lasting legacy in support of student success and lifelong learning.

A deferred gift may be unrestricted and applied toward greatest needs, or designated

to support scholarships, an academic program or student services. The SMC Foundation

is happy to work with you to help ensure your wishes are made clear and honored. SMCF

honors a donor's stated intent for the use of a gift. Donors who wish to designate

the use of any gift, whether made during their life or through their estate, will

have that wish honored. It is best to contact Santa Monica College Foundation in advance

for assistance to ensure that your wishes are properly understood and documented.

Please fill free to fill out this form to notify us of your intent

Link to Statement of Including SMC in Estate Plan

You can designate funds to the SMC Foundation Fund for greatest need, a named scholarship, academic program, or student aid fund (i.e., Meal Project). You can also designate Santa Monica College Foundation as a beneficiary of your donor advised fund.

How to make a grant/gift to Santa Monica College Foundation:

- Request a grant distribution through your DAF sponsor.

- Be sure to use Santa Monica College Foundation’s EIN # 95-6047779.

- Indicate how you would like your donation designated.

Options include:- SMC Foundation Fund, which is applied to greatest current needs.

- Named scholarship: Include the full name of the scholarship.

- Program: Include the full name of the program. Examples include, SMC Emeritus, SMC Associates, Meal Project, Music Program, Film Program, etc.

- Indicate frequency: One-time donation or recurring (monthly, annually, etc.).

- Mailing Instructions:

Santa Monica College Foundation

1900 Pico Blvd.

Santa Monica, CA 90405

Additional questions? Contact foundation@smc.edu or 310-434-4215

Your recurring monthly gift through your pay check benefits thousands of SMC students each and every year.

- Download and complete the fillable Payroll Deduction Form below.

- Return the completed form to foundation@smc.edu or mail it to

Santa Monica College Foundation

1900 Pico Blvd.

Santa Monica, CA 90405

Charitable giving comes in many shapes and sizes. The SMC Foundation appreciates donors who give of their time, their talent as well as those who give of their treasure. All are important; all help our college to serve our students and our community.

Gifts of Personal Property

When you give The Foundation products, you are making a “Gift-in-Kind.” These gifts fall under special IRS rules and regulations, and The Foundation makes sure that we follow these rigorously.

For example, the IRS does not allow us to provide you with the dollar value of your in-kind gift. This doesn’t mean that your gift has no worth—on the contrary— your in-kind gift is important and appreciated, but only you can put a price tag on your gift. If you value an in-kind gift at $500 or more, you will have to submit IRS form 8283 (http://www.irs.gov/pub/irs-pdf/f8283.pdf) with your tax return. For gifts you value at over $5,000 the IRS also requires an independent third-party appraisal.

Gifts of Time and Service

While your time and your talent are invaluable to us, and we truly appreciate our volunteers who make our work possible, the IRS will not allow you to take a tax deduction for either your time or your services.

Check out the options for creating a named scholarship for SMC students.

How to create a scholarship

Nothing feels better than being able to leverage your gift to the SMC Foundation. Corporate matching gifts are a perfect way to increase the size of your gift without digging more deeply into your pocket. Many corporations will match your charitable contribution to SMC Foundation. While most companies will match dollar for dollar up to a specified amount, some companies will double or even triple your gift.

To find out if your company will make a match, simply ask your human resources or personnel office. If they do, request the matching gift form and send it in to SMC Foundation along with your donation. For more information, please contact our offices at 310.434.4215 .

Santa Monica College Foundation participates in a charitable gift annuity program sponsored by the Community College League of California and the Network of California Community College Foundations. Experts are available who can draft an annuity contract as well as offer assistance and consultation for anyone wishing advice on will preparation, and other planned giving options. For more information, please contact our offices at 310.434.4215 .

A variety of trusts can be created to suit one’s own needs. A trust can be designed to provide life income for the donor and a significant other with the residual principal, at a future date, going to the SMCF. For more information, please contact our offices at 310.434.4215 .